How to win over...

How to win over… Asia’s discerning luxury beauty consumers

Tiffany & Co ping pong paddles, a gold-covered burger, that martini with a one-carat diamond (the world’s most opulent choking hazard?). These are just some of the most ludicrous items that come to mind when we think of luxury.

After all, isn’t the point of luxury having the means to be outlandishly excessive?

“If you really zoom out, the definition of luxury is about unnecessary specs,” agreed Mario Braz de Matos, co-founder of Flying Fish Lab, a digital branding agency headquartered in Singapore.

He pointed to Vertu, a luxury mobile phone brand and subsidiary of former mobile giant Nokia, as a prime example.

Back in the early-aughts, Vertu charged a hefty price tag for their craftsmanship. Unlike the run-of-the-mill mass-produced phone, each was handmade using premium and precious materials such as diamonds, titanium, gold, and high-quality leathers. What’s more, owning a Vertu phone granted you access to an exclusive concierge service that could help you make reservations at high-end restaurants or get invites to exclusive events.

All of these and more to justify price tags that could well exceed $10,000 and go as high as $100,000.

Even though Vertu still exists today under different ownership, it is not actively regarded as a prominent or relevant player in the mobile phone game. Tech publication Wired has even referred to it as the “cockroach of phone companies” that “refuses to die”.

With hindsight, it is easy to understand why Vertu failed. The consumers – even the ones with more money than sense – shifted their priorities to functionality and features. With brands like Apple and Samsung focusing on advanced features and technology, it was difficult for Vertu to justify its exorbitant prices based solely on luxury and craftsmanship.

Now, doesn’t that sound familiar?

In today’s beauty landscape, where efficacy and performance are paramount, luxury brands are being challenged to prove they are worth the extra zeroes.

“People are still buying premium and luxury products, but right now with all the economic pressures, beauty brands need to work harder to show why they should pay more,” said Allie Rooke, CEO of Clean Beauty Asia, an agency that helps brands enter and navigate the Asian market.

“There’s the softer side, like inclusivity and sustainability, but there’s also the harder stuff like efficacy and clinical data that luxury brands didn’t have to worry much about before.”

Show me the efficacy!

Rooke believes this is why the Estée Lauder Companies’ (ELC’s) eponymous brand has been struggling in Asia in recent years. The firm has reported two consecutive net sales declines in this fiscal year for the brand, attributed to troubles in Asia, namely in China and the travel retail market. The Estée Lauder brand also reported net sales decline for the 2023 fiscal year.

“The Estée Lauder brand itself doesn’t really talk about anything concrete. It’s about the brand image, the price point, and the status – and that’s not enough now,” said Rooke.

The woes of the heritage brand were also highlighted by experts in a previously published piece by CosmeticsDesign-Europe editor Kirsty Doolan.

Sophie Mitchell, associate analyst for beauty at Global Data, said that Estée Lauder has not sufficiently kept up with the times. She pointed out that while its iconic Advanced Night Repair serum is still considered a cult product, it currently faces stiff competition from brands – including ELC’s very own The Ordinary, which is more ingredient- and science-focused at a very affordable price.

Rooke echoed similar sentiments: “With fragrance or makeup, maybe it’s about luxury for luxury’s sake, but not skin care. Consumers are much more discerning. They may buy something from a luxury brand and others from the drugstore. Even someone who has a lot of money might buy a few products from The Ordinary. That’s what’s changed a lot.”

Source: Euromonitor International

Rooke continued: “The ones that are going to come out on top are the ones that can really dial up the science. One brand that has done exactly that is Helena Rubinstein.”

Helena Rubinstein, founded in 1902, was acquired by the L’Oréal Groupe in 1984. Until very recently, it had all but been relegated to the annals of beauty history mostly for its founder’s legendary rivalry with fellow doyenne, Elizabeth Arden.

In 2023, Helena Rubinstein joined L’Oréal’s billionaire brand club. L’Oréal chief Nicolas Hieronimus and luxury division leader Cyril Chapuy have both indicated it to be one of the group’s most successful transformations in its history.

Much of that success boils down to its strong focus on science as part of its ultra-premium beauty positioning. In 2008, the brand partnered with the Swiss aesthetic clinic, Laclinic-Montreux, to develop the Replasty range of products, which aimed to offer science-backed anti-ageing solutions. The brand’s resurgence also aligned with the interest in cosmetics and aesthetic procedures, further cementing its relevance to consumers, especially in Asia.

The Replasty Age Recovery night cream, which retails for EUR470 for 50mls, is one of the top-selling beauty products in China today. Other top products include its Powercell Skinmunity Youth Reinforcing Serum (EUR200, 50ml), which leverages biotech to develop samphire plant stem cells.

This focus on science and technology is even more important in the Asian skin care market.

“In Western markets, some of the soft things that luxury brands can produce to give them value don't work so well in Asia. I think because the mindset of the Asian consumer is just more direct, more analytical, and more scientific,” said Rooke.

It seems like Estée Lauder understands that the focus on science is what consumers are craving from them. Last December, it announced its new skin longevity initiative to cement itself as an authority of longevity science.

“Longevity is one of the fastest growing movements in the beauty and wellness industries, with multi-generational consumer interest in biohacking and age-reversal practices at an all-time high. Estée Lauder has been pioneering skin longevity research for more than 15 years, and we already have the proven technology to reveal visible age reversal. We see this as a truly pivotal moment for the brand to disrupt the industry, changing what we know about skin ageing and reimagining skincare for the future,” said Justin Boxford, global brand president of Estée Lauder.

In January, Estée Lauder also unveiled Re-Nutriv Ultimate Diamond Transformative Brilliance Soft Crème, with SIRTIVITY-LP which it claims can show visible age reversal starting in just 14 days. SIRTIVITY-LP is part of its latest research in skin longevity science, which it first unveiled in Singapore at the World Congress of Dermatology last July.

According to the firm, this emphasis on longevity science has shown positive signs for the Estée Lauder brand.

“While early, the franchise is welcoming new consumers at compelling rates, and we look forward to all that is to come for Re-Nutriv as launch events continue around the world. Moreover, the brand is collaborating with the Stanford Centre of Longevity as the inaugural sponsor of a new program of aesthetic and culture,” said ELC chief executive Fabrizio Freda in February.

New definitions: Luxury goes quiet

In 2023, quiet luxury was the understated style movement that redefined luxury fashion. The trend favoured an aesthetic that is understated, subtle, and discreet. Think designer brands like Loro Piana, Brunello Cucinelli, Tove, and The Row, which eschew maximalism and logomania for more fundamental principles of luxury – quality, craftsmanship, and exclusivity.

This movement has begun to seep into beauty. Not dissimilar to conscious and minimalist beauty, it manifests as smaller, more curated beauty routines comprising of only the best, most effective, most potent products. In short, minimal product with maximum performance.

“If we look at the fashion trends last year, it’s become more about new-age minimalism with a focus on investment pieces – pieces that will last over time. It’s not about breaking the bank in the name of a trend. In beauty, we’re seeing the same. We’re looking at skin care as an investment. Rather than overnight, flash-in-a-pan trends, and celebrating tried and true quality ingredients that have stood the test of time. If we drill down to it, the definition of luxury now means quality rather than opulence,” said Mukti, founder of Australian beauty brand Mukti Organics.

Shiseido-owned luxury brand Clé de Peau Beauté has also positioned itself at the forefront of this burgeoning movement.

“The ongoing pursuit of holistic well-being post-pandemic continues. Beauty trends embracing quiet beauty coupled with natural radiance, skin health and simple comfort are now becoming ever more important,” said Nancy Thong, Regional Brand Director, Clé de Peau Beauté, Shiseido Asia Pacific.

“Products with strong science-backed innovation using premium ingredients, with testimony to both efficacy and quality is continually propelling the industry forward. This is aligned with Clé de Peau Beauté's commitment to science and innovation, solidifying our brand's position at the forefront of the evolving beauty landscape.”

Mukti added that quality will increasingly become synonymous with ethical practices such as transparency and sustainability.

“Many luxury brands are responding to that by incorporating eco-friendly practices into their production processes. I think that we've got to be more sustainable and also transparent because the consumer is asking for that level of transparency. Consumers are switching brands if they're not getting that assurance that brands are keeping up with that.”

For more of Mukti’s insights into the quiet beauty movement, check out our video below:

The cherry on top

Alright, now let’s address the elephant in the room: the fact that performance and efficacy are not exclusive to luxury prices.

The beautiful thing about the beauty market today is that despite your budget, you can find something great at every price point. The Ordinary, a brand known for its scientific approach to skin care, rarely has products that cross the USD30 mark and has over a dozen products that cost less than USD10.

Pro-Xylane, L’Oréal’s patented power molecule is a sugar-molecule derived from the beech wood tree utilising green chemistry. It is found in Helena Rubinstein’s aforementioned Replasty cream, as well as L’Oréal Paris’ Triple Action Renewing Anti-Aging Serum (USD58).

According to the company, it functions by “stimulating the production of proteoglycans, a water-absorbing molecule in human reconstructed skin. Higher levels of proteoglycans within the reconstructed skin’s extracellular matrix correlate to increasing skin-elasticity and firmness.”

And it is not just the hard science we are talking about. Italian masstige brand Teaology boasts formulations that are 95% to 100% natural origin according to the ISO 16128 standard. Furthermore, it has been certified by B Corporation and Environmental Working Group (EWG).

The good news for consumers is that great brands are increasingly bountiful on the high street and in the drugstores. The industry can only expect their level of quality to keep on rising and rising, thus pressuring the luxury beauty segment to justify their value.

“Luxury is struggling… The products are becoming so easy to reach. It’s down to how you find a need, a perspective, a way to tell a story that captivates consumers. The beauty industry was never really about function if you think about it – it was always about how you feel. That lipstick doesn’t make you prettier, it makes you feel prettier,” said Braz de Matos.

The veteran marketer’s advice to luxury beauty brands was to “stop thinking of the brand as a product and think of the consumer holistically.”

“Was it ever about the product? Brands must be more than the product in the box. At the end of the day, consumers aren’t just the buyer of the product, especially if you’re going towards luxury. If you define yourself as a brand that sells products in tubes or sprays, you're going to be dead in 20 years.

“That ability for you to provide a complete experience is going to make a difference. You're bound to see brands experimenting with things like vertical integration. You might see a skin care brand doing something with a clothing brand. If you focus on the values and experiences to try and build for consumers, then it doesn't matter what shape the physical world takes, because it could be a cream or a spray, but it could be food, it could be music. Thinking outside the box is going to be a requirement.”

Rooke highlighted that the experiences consumers seek are shifting, especially with the younger set.

“Gen Zs – the ones that are starting to spend most on luxury products – want to feel like the brands they are buying from are a reflection of them in a more holistic way than previous generations. Everything they buy, everything they do, is all about their personal brand. This is not like previous generations that want to show off. It’s about buying the right product that reflects who I am, which is more important than what’s external.”

What this means is that the experiences brands offer must be holistic. For instance, it could be something that enriches them in other ways other than beauty.

For Elizabeth Arden, the key to connecting with beauty consumers in China has been underlining the brand’s feminist values through its founder’s story.

“In China, there is an increasing drive for women’s independence and freedom of choice in life. Such strong internal drives are symbolic of the philosophy and values behind our brand,” said Yumie Chia, general manager of Elizabeth Arden APAC travel retail.

“Our brand founder, Ms Elizabeth Arden, was a legendary woman of her time. She went against tradition in a world led by men to fulfil her dreams as a self-made woman. She became the first businesswoman to grace the cover of TIME magazine. She was also the first woman to be inducted into the US Business Hall of Fame.”

Chia explained that these values were reflected in the Prevage line, one of its core skin care drivers.

“Prevage is a franchise with strong positive values. Being one of the best antioxidant serums in the industry, Prevage serves as a strong pillar of support for women who embrace life positively. You would often notice that our Prevage users are usually well-established in life and leading very fulfilling or busy lifestyles. They do not compromise on their grooming and looks. They will ensure that they continue to look good while pursuing their dreams.”

Last December, the brand hosted an event for its VIPs, which included high tea as well as activities such as beauty masterclasses and self-improvement talks. The goal was to inspire women with the story its brand founder and Prevage. Emphasising brand values and storytelling has been crucial for the brand’s success in China and the company will continue to leverage on it.

According to the brand, it has been performing well in China’s travel retail market, ending 2023 with double-digit growth. Chia told us that the firm expects this momentum to lead to more growth in 2024.

“We believe it is important to continuously drive our brand values to customers and prospective customers. We will be continuing our storytelling approach in our workshops and activations. We plan to conduct more and bigger scale beauty workshops with our customers. By combining experiential learning with storytelling, our customers will be able to appreciate our products and brand better,” said Chia.

Jitha Thathachari, group head, business development, strategy and transformation, LUXASIA, echoed the shifts in the luxury market, emphasising the importance of innovation as well as clinical proof.

He added that brands must strike a new balance by “establishing non-negotiables and a deep sense of purpose for the brand – maintaining brand equity, exclusivity, and quality despite investor pressure to drive sales and increase bottom-line, especially for listed brands and companies”.

Thathachari concluded: “A heavier price tag is only justifiable when all the higher expectations today are met.”

Asia’s luxury market: The next chapter

Considering the past few turbulent years, the APAC luxury beauty market remained remarkably resilient.

According to data from Euromonitor International, the market fell the most (6.9%) from 2019 to 2020 to USD17.8bn. It bounced back the following year by 19.1% to USD21.1bn. In 2022, the market reported another dip (4.9%) to USD20.1bn before climbing back to USD21.7bn in 2023, an increase of 8.1%.

The biggest category by a longshot is skin care (no surprises here), which was worth USD11.4bn in 2023. Colour cosmetics follows at USD5.8bn and fragrance at USD3bn. All three categories have exceeded 2019’s pre-pandemic figures. From 2022 to 2023, skin care, makeup, and fragrance grew at the rates of 7.6%, 8.8%, and 9.1% respectively.

From 2019 to 2023, the category that has experienced the biggest growth was fragrance, which grew by 26% from 2020 to 2021. It saw a slight decline (1.4%) from 2021 to 2022 but improved by 9.1% from 2022 to 2023.

Moving forward, the luxury market in Asia remains a lucrative prospect. Asia is not only the largest, but the fastest-growing region for luxury beauty players, growing at a CAGR of 11% over the next five years, according to Euromonitor.

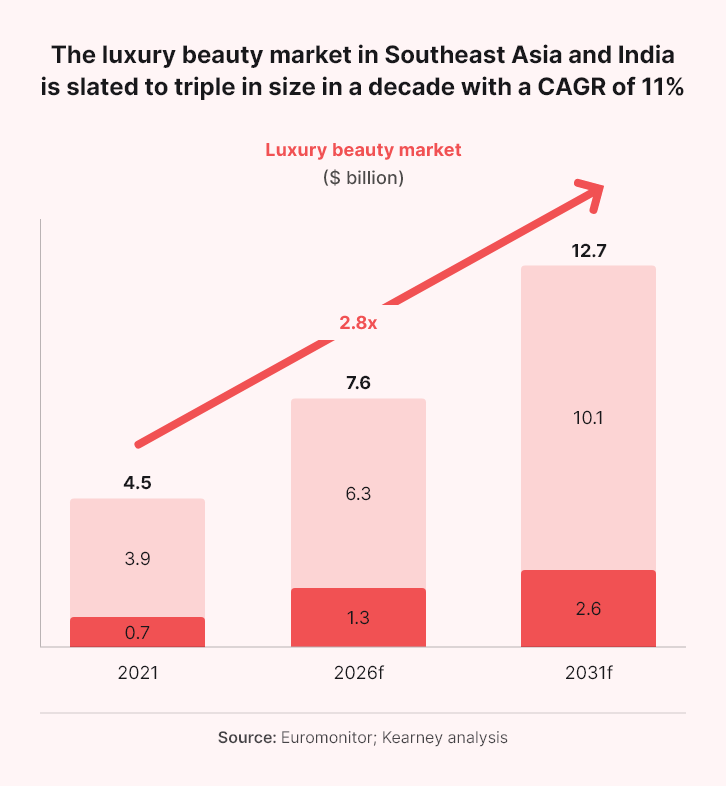

Singapore-headquartered omnichannel luxury beauty distributor LUXASIA has identified South East Asia and India as the most promising markets for growth with the region predicted to triple in size over the next decade. This comes as markets like China, Japan, and South Korea have started to mature and grow saturated.

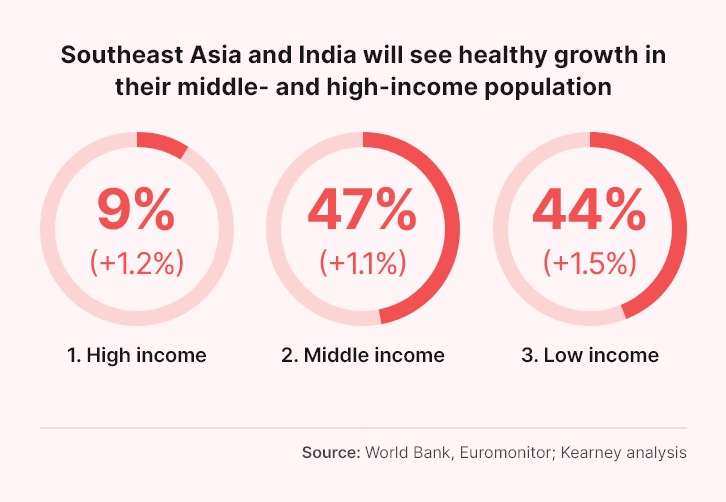

According to a recent report published by LUXASIA and management consulting firm Kearney, the combined size of the middle- and high-income classes in SEA and India is estimated to reach 867 million in 2026.

The markets share similar characteristics, such as a growing and affluent middle class, increasing sophistication of consumers, and developing societies where more women are increasingly educated, empowered, and supported in their career aspirations.

“I think with a lot of these markets, they are still in that stage China was before, it’s that hunger for luxury for luxury’s sake. You've got the emerging middle class in many countries that are still aspiring to buy some of those luxury brands because they’ve been working the last 10, 15 years of their lives waiting to get,” said Rooke.

Within SEA, LUXASIA’s focus is on Vietnam, Indonesia, and the Philippines – dubbed the VIP markets. The company expects the markets to grow by around 8% to 10% over the next five years. The company considers Indonesia to have a strong outlook for the future, while Vietnam and the Philippines are considered moderate-good.

These markets have “a relatively deeper love and penchant for luxury brands,” observed Thathachari.

He also highlighted the myriad of differences between the countries, including beauty behaviour, logistical challenges, and regulation.

On the other hand, India is expected to grow from 12% to 14% over the next five years, according to LUXASIA.

Indian beauty and fashion retailer Nykaa believes its future growth will depend on the growth of luxury beauty in India.

“The premiumisation of beauty is a trend that's happened globally, especially if you look at China over the past 15 years. And India has not even begun that trend yet. Today, prestige or premium is less than 10% of overall BPC spend in India, so it's very under-indexed,” said Anchit Nayar, chief executive of beauty e-commerce, Nykaa.

Nayar sees this as a major opportunity for the company, highlighting that “today's value shopper is tomorrow's prestige shopper.”

However, he acknowledged that the firm must overcome the challenge of consumer education. “It's not really an affordability issue. It's more of an awareness issue.”

Thathachari highlighted more challenges such as the heterogeneity of the market itself, local legal and regulatory framework, as well as the complexity of luxury beauty distribution and retail operations management.

The luxury beauty segment in Asia Pacific is at a crossroads. The challenge lies in justifying high prices to increasingly discerning consumers amidst economic uncertainties. This dynamic landscape calls for strategic innovation, impeccable quality, and compelling holistic value propositions to maintain and attract consumers in a rapidly evolving beauty market.

![YSL's LoveShine launch has sparked a demand surge in Japan. [YSL]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/04/24/ysl-loveshine-launch-propels-lip-gloss-sales-to-record-highs-in-japan-since-2020/17372064-1-eng-GB/YSL-LoveShine-launch-propels-lip-gloss-sales-to-record-highs-in-Japan-since-2020.jpg)

![News updates from Shiseido, Dr.Ci:Labo, Sephora, and more. [Shiseido]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/headlines/brand-innovation/updates-from-shiseido-dr.ci-labo-sephora-and-more/17334944-1-eng-GB/Updates-from-Shiseido-Dr.Ci-Labo-Sephora-and-more.jpg)

![Able C&C has furthered its partnership with Japanese discount chain Daiso with new makeup launch. [A'pieu]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/headlines/brand-innovation/a-pieu-and-daiso-launch-exclusive-2-makeup-line/17339117-1-eng-GB/A-pieu-and-Daiso-launch-exclusive-2-makeup-line.jpg)

![Down Under Enterprises is setting sights on the Asian market as environmental sustainability and traceability become increasingly important. [Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/cosmetics/cosmeticsdesign-asia.com/headlines/market-trends/down-under-enterprises-shifts-focus-to-china-as-environmental-sustainability-traceability-come-into-the-spotlight/17304932-1-eng-GB/Down-Under-Enterprises-shifts-focus-to-China-as-environmental-sustainability-traceability-come-into-the-spotlight.jpg)

![[Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/china/china-focus-latest-developments-in-china-s-booming-beauty-market22/17370102-1-eng-GB/China-focus-Latest-developments-in-China-s-booming-beauty-market.jpg)

![YSL's LoveShine launch has sparked a demand surge in Japan. [YSL]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/04/24/ysl-loveshine-launch-propels-lip-gloss-sales-to-record-highs-in-japan-since-2020/17372064-1-eng-GB/YSL-LoveShine-launch-propels-lip-gloss-sales-to-record-highs-in-Japan-since-2020.jpg)

![There is significant scope for innovation and new launches in the hair repair sector, especially in soaring markets such as China. [Getty Images]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/article/2024/04/24/croda-zeroes-in-on-hair-repair-solutions-as-damage-hair-concerns-surge-in-markets-like-china/17362731-1-eng-GB/Croda-zeroes-in-on-hair-repair-solutions-as-damage-hair-concerns-surge-in-markets-like-China.jpg)

![Lubrizol has extended its partnership with C-beauty major PROYA. [PROYA]](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_tiny/publications/cosmetics/cosmeticsdesign-asia.com/headlines/brand-innovation/lubrizol-bullish-on-potential-of-c-beauty-growth-potential/17362515-1-eng-GB/Lubrizol-bullish-on-potential-of-C-beauty-growth-potential.jpg)